Understanding credit is crucial if you want to gain more control over your financial situation. Having a good credit education can help you find ways to make the most of your credit by learning how it works, how to use it, how to improve your score, and most importantly, how to protect it from activities that could affect it negatively.

UNDERSTANDING YOUR CREDIT REPORT

A credit report contains almost all the information about your financial credit history. Lenders use this information to determine whether to give you credit or not.

What Information Does A Credit Report Provide?

Your credit report provides information related to your account containing the record of your past and present credit payment history and behavior. The information in your credit report is classified generally into three categories

Credit History

The number and type of accounts opened, active, and closed for a credit card, auto loan, mortgage, and others. The age of your credit accounts, your credit utilization rate, the account balances, and your payment history showing the number and extent of late payments.

Credit Inquiries

When you check your credit or if a company or a person asks legally to see your credit report. There are two types of inquiries, hard and soft. Hard inquiries happen after your permission for a specific transaction. Soft inquiries do not show up on your report, and they appear every time you check your credit report.

“Lenders will only see hard inquiries and consider them to approve your loan application and the basic of terms.”

Public Records and Collections

It consists of information on overdue debt from collection agencies related to bankruptcies, foreclosures, suits, wage garnishment, and liens.

Apart from these, your credit report includes your general identification details such as- your name, address, Social Security number, date of birth, etc.

When Do Lenders Use Your Credit Report?

Lenders make use of your credit report in diverse situations, specifically when you apply for:

- Mortgages

- Credit cards

- Personal loans

- Overdrafts

- Mobile phone and some utility contracts

Lenders make use of your credit report in diverse situations, specifically when you apply for:

Credit Reporting Agencies

Credit reporting agencies comprised three credit bureaus- Experian, Equifax, and Transunion. They provide valuable insight into the details of your credit health by offering you a free annual credit report annually.

The top three credit reporting agencies differ in their credit scoring ranges and calculations.

TransUnion

Experian

Equifax

IMPROVING YOUR CREDIT SCORE

A credit score plays a key role in whether a lender will offer you a credit or hold your request by analyzing the score if a consumer will be able to pay their bills on time, and in particular, their debts.

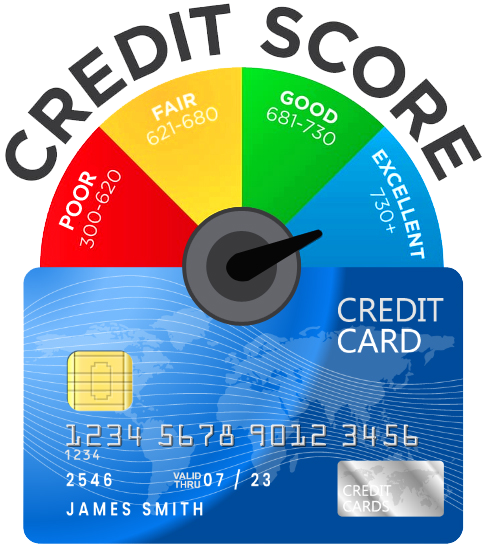

What Is a Credit Score?

A credit score is usually calculated between numbers 300–850 to depict a consumer’s creditworthiness. Though there is no ideal score, aiming for a higher score increases your chances to get credit on best interest rates. A credit score is determined based on your credit history, including the number of your current accounts, your debt level, your repayment history, and other related factors.

What is a Good Credit Score?

Based on the preferred scoring range of 300 to 850, a score of 740 to 850 and above is generally considered ‘good’ or ‘excellent, which means you are most likely to qualify for credit with the lowest rates.

What is a Bad Credit Score?

Scores less than 601 are generally considered ‘unfavorable’ or ‘bad.’ It reduces your chances to not qualify for the credit, or if somehow you get, it would be not on the best rates.

Here are the score ranges under FICO®. It is one of the most widely used systems

Poor

Fair

Good

Very good

Exceptional

How to Improve Your Credit Score?

Any new information added in a borrower’s credit report impact their credit score and it can rise or fall based on updated information. While there is no quick fixes but with these tips, you can improve your credit score

- Make timely payment

- Optimize credit utilization rate

- Refrain from closing accounts

- Monitor credit report for any inaccuracies

- Take help from a reliable credit repair company

CREDIT MONITORING & IDENTITY THEFT

Credit monitoring enables you to be aware of any fraud alert or data breach whenever a change is made to any of your credit reports so that you can take proactive measures such as credit freeze.

If you have been a victim of identity theft, it becomes all the more important to opt for a professional credit monitoring service. Choose New Life Credit Repair as we help draw credit information from all three major credit reporting agencies with most of the details.

Our Identity Theft Protection Services Include

Monitoring

Credit files and alert you about any suspicious activity.

Alerts

Where your personal information has been used without your knowledge.

Recovery

Help recover lost money and reverse the damage to your credit.

EXPERT CREDIT ADVICE

When it comes to personal finance advice, experts at New Life Credit Repair have a lot to offer.

In our research and experience in handling different cases over the past year, NLCR has gained a variety of useful information to share with credit card users on using credit cards responsibly.